does square cash app report to irs

Does The Cash App Report To IRS. Tax Reporting for Cash App.

Square S Cash App Vulnerable To Hackers Customers Claim They Re Completely Ghosting You

Its not a new tax but the IRS is looking closely at transactions that are 0 or more.

. All financial processors are required to report credit card sales volume and then issue a 1099K I think its a K for that amount so that gets automatically reported to the IRS. Tax Reporting for Cash App. Can you transfer money from square to cash App.

Cash App is required by law to file a copy of the Form 1099-B to the IRS for the applicable tax year. If you dont have an EIN you can apply for one with Squares free EIN assistant which guides you through the application. No need to check your mailbox we wont be sending a paper copy you can download your 1099-K form on the Tax Forms tab of your Square Dashboard.

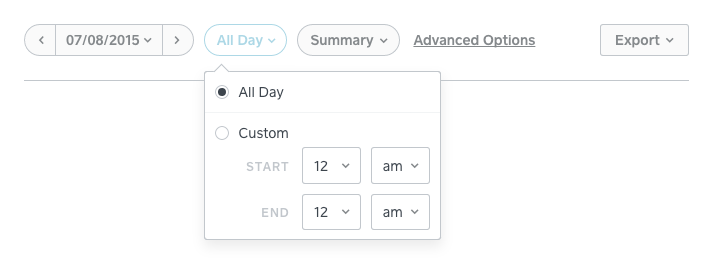

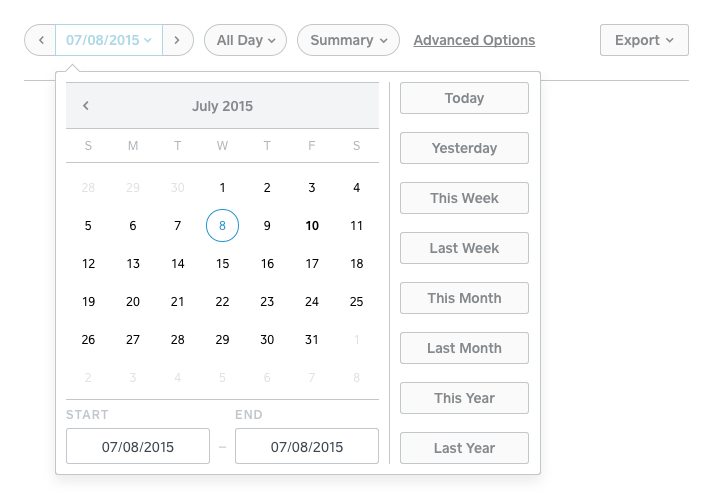

Beginning this year Cash app networks are required to send a Form 1099-K to any user that meets this income threshold. Log in to your Cash App Dashboard on web to download your forms. A Form 1099-K is the information return that is given to the IRS and qualifying.

Certain Cash App accounts will receive tax forms for the 2018 tax year. If your taxpayer information is associated with Massachusetts Vermont Maryland Washington DC or Virginia we are required to issue a Form 1099-K and report to your state when you accept 600 or more. Square is required to issue a 1099-K and report to the IRS when you process 600 or more in credit card payments.

Forms will be available by January 31st. A business transaction is defined as payment. Payment app providers will have to start reporting to the IRS a users business transactions if in aggregate they total 600 or more for the year.

Filers will receive an electronic acknowledgement of each form they file. A person can file Form 8300 electronically using the Financial Crimes Enforcement Networks BSA E-Filing System. Does Cash App report to the IRS.

Remember there is no legal way to evade cryptocurrency taxes. All credit card processing companies including Square are required by the IRS to report the earnings of those merchants who process over 20000 and over 200 credit card payments cash excluded per calendar year before January 31. Tax Reporting for Cash App.

The IRS requires Payment Settlement Entities such as Square to report the payment volume received by US. Square does not currently report to the IRS on behalf of their sellers. For any additional tax information please reach out to a tax professional or visit the IRS website.

Where do I get my 1099-K form. Any 1099-B form that is sent to a Cash App user is also sent to the IRS. Certain Cash App accounts will receive tax forms for the 2021 tax year.

Likewise people ask does Cashapp report to IRS. Soon cash app earners will need to report to the IRS. They are also required to file a corresponding tax form with the IRS.

Cash App for Business accounts that accept over 20000 and more than 200 payments per calendar year cumulatively with Square will receive a Form 1099-K. Square Inc the parent company of the financial services app Cash App acquired Credit Karmas free DIY tax filing service and reb. I believe they would have to get a warrant or supena or court order of some sort.

Square is required to issue a 1099-K and report to the IRS when you process 600 or more in credit card payments. Herein does Cashapp report to IRS. Starting January 1 2022 cash app business transactions of more than 600 will need to be reported to the IRS.

For any additional tax information please reach out to a tax professional or visit the IRS website. People report the payment by filing Form 8300 Report of Cash Payments Over 10000 Received in a Trade or Business PDF. This only applies for income that would normally be reported to the IRS anyway.

By Tim Fitzsimons. You can also apply for an EIN from the IRS. Current tax law requires anyone to pay taxes on income over 600 regardless of where it.

Certain Cash App accounts will receive tax forms for the 2018 tax year. Log in to your Cash App Dashboard on web to download your forms. Beside above how much tax does Cash app take.

2 days agoStarting in 2022 mobile payment apps like Venmo PayPal Cash App and Zelle are required to report business transactions totaling more than 0 per year to the Oct 04 2021 Is the IRS Really About to Tax Your Venmo PayPal and Cash App Transactions. E-filing is free quick and secure. Will the IRS receive a copy of my Form 1099-B.

If you have a Cash App account you are able to receive transfers. Cash apps like Venmo Zelle and PayPal make paying for certain expenses a breeze but a new IRS rule will require some folks to report cash app transactions to the feds. Under the original IRS reporting requirements people are already supposed to.

Not filing your cryptocurrency taxes is considered tax fraud and is punishable through a maximum penalty of 100000 and potential jail time. Formerly Square Inc a leader in the financial technology industryCash App is just one part of Blocks business. Tax law requires that they provide users who process over 20000 and 200 payments with a 1099K before January 31st 2012.

Cash App is a popular peer-to-peer P2P payment service owned by Block Inc. Does square report cash transaction made in their POS to IRS. How is the proceeds amount calculated on the form.

1 2022 users who send or receive more than 600 on cash apps must. 1 mobile payment apps like Venmo PayPal and Cash App are required to report commercial transactions totaling more than 600 per year to the Internal Revenue Service. Yes you will receive a 1099-K form next year if you receive more than 600 on an app.

Log in to your Cash App Dashboard on web to download your forms. The 1099-B will also be available to download from your desktop browser at httpscashappaccount. For any additional tax information please reach out to a tax professional or visit the IRS website.

PayPal Venmo and Cash App to report commercial transactions over 600 to IRS. Payments platform Square is now suggesting users deposit their COVID-19 stimulus payments through its Cash App for faster and easier access to the funds in the event someone doesn. Americans for Tax Reform President Grover Norquist discusses the impact of third-party payment processor apps.

Solved Everything You Need To Know About 1099 K Tax Forms Page 2 The Seller Community

Falcon Expenses Expense Report Template Expense Tracker Mileage Tracker App Tracking Mileage

Summaries And Reports From The Online Square Dashboard Square Support Center Us

Summaries And Reports From The Online Square Dashboard Square Support Center Us

Solved Your First Tax Season With Square The Seller Community

Form 1099 K Tax Reporting Information Square Support Center Us

How To Do Your Square 1099 Taxes

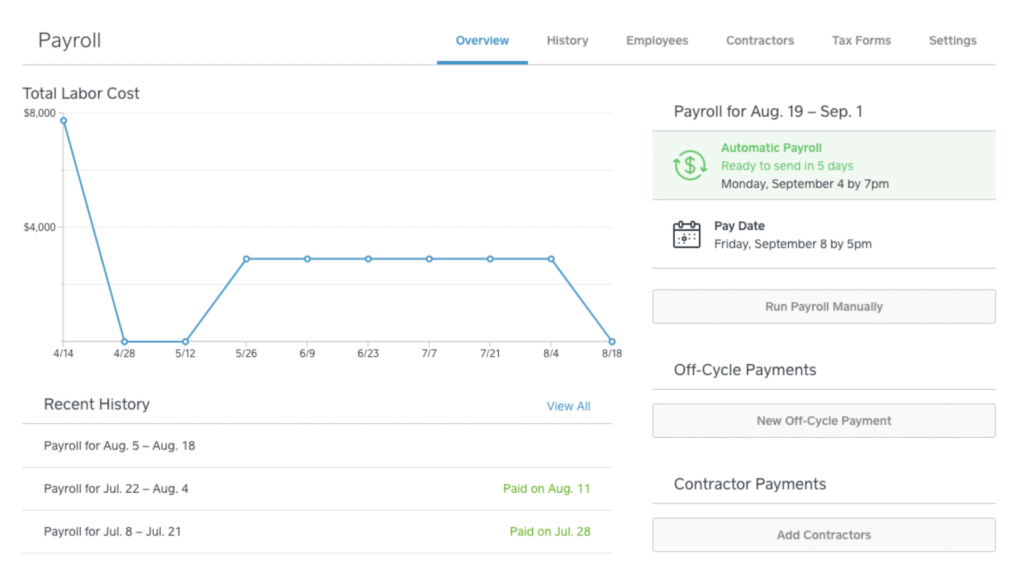

Square Payroll Review Pricing Features

5 Form 5 Pdf 5 Things You Won T Miss Out If You Attend 5 Form 5 Pdf

Form 1099 K Tax Reporting Information Square Support Center Us

How Does Paypal Venmo Zelle Stripe And Square Report Sales To The Irs Will You Receive A Tax Form 1099 K For 2019 By Steph Wynne Medium

Irs To Start Taxing Certain Money Transfer App Users Nbc2 News

The Ultimate Square Pos Setup Guide

Does The Irs Want To Tax Your Venmo Not Exactly

Information Requested For Square Loan Application Faq Square Support Center Us

Income Reporting How To Avoid Undue Taxes While Using Cash App Gobankingrates

New Tax Law Sell More Than 600 A Year Venmo Paypal Stripe And Square Must Report Your Income To The Irs